Navigating the Opportunities and Challenges of Modern Retirement

Not so long ago, retirement was pretty much a one-way ticket to the armchair or garden centre! Now I’ve nothing against armchairs or garden centres but the prospect of spending a couple of decades in either wouldn’t exactly fill me with joy and anticipation!

Thankfully, today’s retirees are the beneficiaries of some radical changes that have evolved over the last few decades. Retirement’s no longer seen as a time to just put your feet up but is now viewed as a positive new beginning – a chance to explore new possibilities and create a new life chapter that’s just as dynamic and fulfilling as the ones that came before, albeit in a different way.

So how come things have changed so radically for this generation?

Well, this is without doubt, a unique and fortunate generation – one that’s healthier, wealthier and better educated than ANY previous generation. They’re living longer, healthier lives, enabling them to stay active and engaged well into their next chapter. Retirees stand to live 20 to 30 years in this phase of life and consequently, many are seizing this opportunity to forge bespoke new lifestyle pathways.

And of course, many women today have spent all or most of their adult lives working outside the home, building careers and establishing themselves as highly valued members of the workforce. And, just as they changed the working world, now that they’re hitting retirement, they’re changing that too! They’re not going to suddenly ditch their desire to be productive, purposeful members of society and submissively accept an outmoded stereotype that no longer fits.

That was never going to happen!

They are as vibrant and engaged as they ever were and now regard retirement as a springboard into a purposeful future. What they seek now is not so very different from what they sought when they first entered the workplace. They wanted to make a difference, feel fulfilled and make a contribution to society then, and they want the same now.

They want to make personal decisions that align with their values and create an outcome that’s right for them. And that’s a retirement lifestyle that’s very different from that of their grandparents, or parents.

They want a modern retirement.

So what does a modern retirement actually look like for women?

Well, for many, it involves some form of work. This might mean continuing to work, either part-time or full-time or choosing to take advantage of new flexible working models by becoming self-employed freelancers or consultants. Or it might mean choosing to start a new business, pursue a passion project, or simply take on a job that’s less demanding than their previous career. Many women also choose to use retirement as an opportunity to give back to their communities, volunteering their time and expertise to causes they care about.

Of course, modern retirement isn’t just about work. It’s also about enjoying life and pursuing interests that may have taken a backseat during the busy years of career and family. This might mean traveling, taking up a new hobby, or spending more time with loved ones. For some women, retirement is a chance to finally indulge in the things they’ve always wanted to do, but never had the time or resources for.

It’s an ideal time to pause and recalibrate and make new or different choices.

CHOICE is a fundamental part of modern retirement – offering a sense of freedom, autonomy, and empowerment. Women today are no longer content to adhere to someone else’s idea of what retirement should look like. Instead, they’re charting their own course and creating bespoke, flexible retirement plans tailored to their individual needs, interests, and goals.

Which is undeniably good news BUT it's not without its challenges.

Choice can be a double-edged sword!

With SO many options to consider – from where to live to how to spend your time – it can be overwhelming to decide what’s best.

And where there is overwhelm, there is procrastination. And where there is procrastination there’s time wasted… and as I’m sure you’re well aware, ‘time’ is a very precious commodity!

The temptation in this situation is to just ‘wing it’ in the hope that things will magically ‘sort themselves out’ into something meaningful, purposeful and enjoyable.

But that’s a LOT to leave to chance, isn’t it?

And yet, that’s exactly how many end up wasting the first few valuable years of retirement – trying to figure out what they really want now, wondering why retirement doesn’t look or feel like they thought it would… or sometimes questioning their decision to retire and worrying about what they could or should have done better or different.

One way to overcome the challenge of ‘too much choice’ when creating a bespoke retirement plan is to start by identifying your priorities.

- What are the most important things to you?

- What are your non-negotiables?

- What do you want more/less of in your next chapter?

- What are you going to continue doing?

- What do you want to change completely?

By getting clear on the fundamentals, you’ll find it SO much easier to narrow down your options and start making decisions.

It will probably come as no surprise at all that my top recommendation is that you call upon the services of a retirement coach such as myself (shameless plug!) – someone who knows the territory well and brings outside expertise to the process. One of the many benefits of working with a retirement coach is that they bring a fresh perspective and help you see new possibilities and options that you may not have considered on your own as well as supporting you to turn your great thoughts and ideas into a fulfilling reality.

Thankfully, the days of the one-size-fits-all retirement are long gone! The undoubted gifts that modern retirement has to offer are there for the taking if you take the time to explore the possibilities before you and actively plan for the future you want. These can be the best years of your life – it’s up to you to make the most of them.

Read more articles ON THE BLOG….

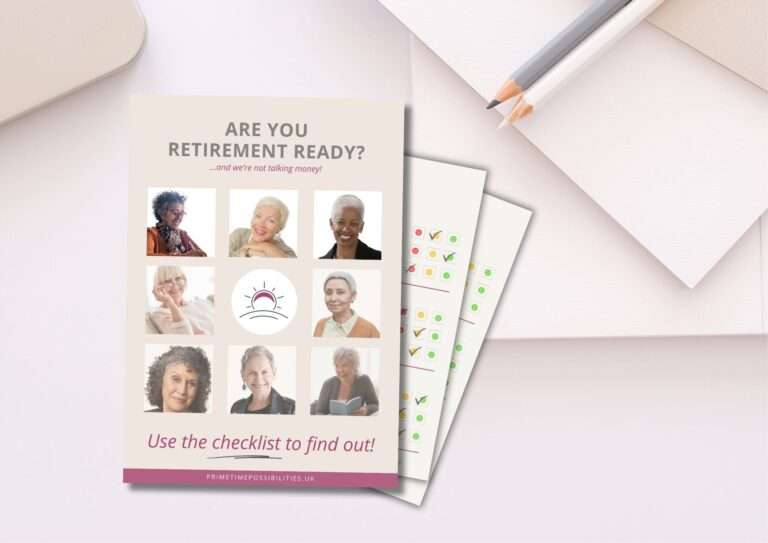

Are You Retirement Ready? (..and we're not talking money!)

Download your FREE checklist and discover your true retirement readiness.

Thank you!

Full details of how to download your checklist will arrive in your inbox soon!

(Please check your spam folder if you don't see an email from me!)

Dreaming of retirement freedom, but feeling stuck in the planning stage?

Don’t worry, you’re not alone! It’s time to take a more holistic approach because while finances ARE important, true retirement readiness goes beyond the numbers.

This isn’t your typical tick-box exercise! Our red, amber, and green system offers instant clarity on your current situation as well as a framework for genuine self-reflection.

This checklist, based on my Six P’s Retirement Framework, will help you build a rock-solid foundation for a happy, healthy, and fulfilling retirement:

- Explore six key areas essential for a truly fulfilling retirement, from health and purpose to relationships and mindset.

- Build clarity and confidence about stepping into this exciting new chapter.

- Stop wasting time in the “not ready” limbo and take control of your future.

- Get intentional about creating your ideal retirement lifestyle.

Sign up for instant access to your FREE checklist* (*both digital and printable)