Is Retirement the Wrong Word for What’s Next?

Is Retirement the Wrong Word for What’s Next?

For a growing number of us, the word retirement just doesn’t sit right.

It feels off. Outdated. Maybe even a little insulting, embarrassing… or simply irrelevant.

So it’s no surprise that more and more people are quietly letting go of the “R word” altogether – because it just doesn’t fit. Not with who they are now, and definitely not with the life they want next.

And I get it. Not just because I’ve heard it in countless conversations with clients and friends, but because I’ve felt it too.

There’s a growing sense that we need a new vocabulary for this time of life. Something that reflects who we are now, and where we’re heading.

This shift is really about rethinking retirement –moving beyond outdated assumptions and finding language that feels more open, more relevant, and more true.

It’s not that we haven’t tried. I’ve seen (and used) all kinds of alternatives – The Third Act, Your Next Chapter, Post-Career Life, Reinvention, Unretirement, Portfolio Retirement.

Some may land better than others. But do any truly resonate with you?

The Four Quarters of Life

For me, the language we use needs to be neutral and non-judgemental, yet broad enough to capture the richness and variety of this life stage.

And that’s a tall order!

But recently, I came across an idea that resonated with me.

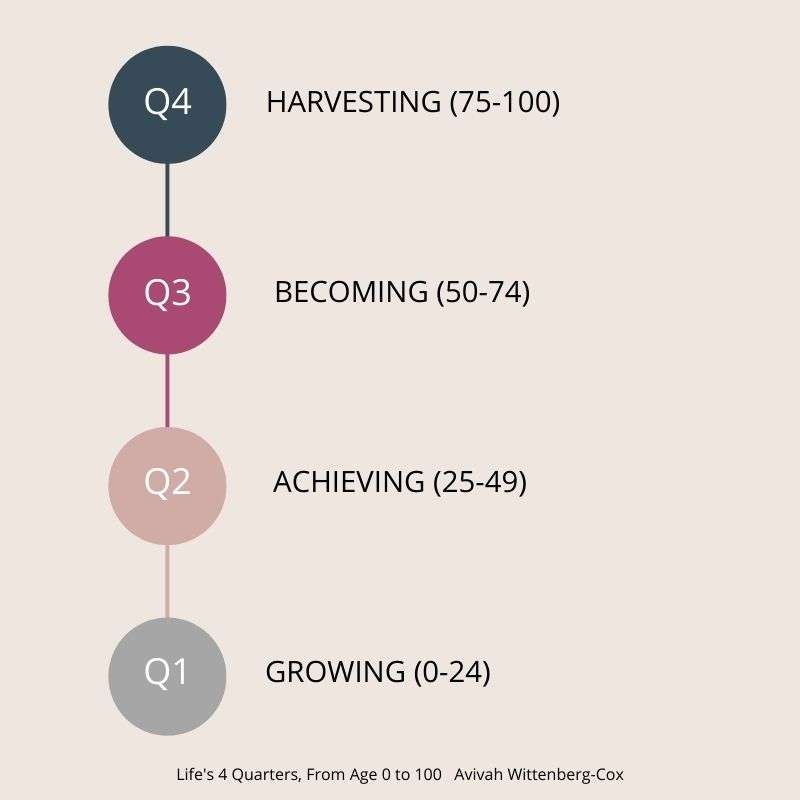

In this article, the author Avivah Wittenberg-Cox, frames life as four phases or Four Quarters, with ‘retirement’ reimagined as Quarter Three.

Here’s the gist:

Q1 GROWING: is our childhood and youth.

Q2 ACHIEVING: is the first half of adulthood – building careers, raising families, juggling different roles etc.

Q3 BECOMING: an entirely new phase representing an extended season of active, purposeful adulthood.

Q4 HARVESTING: is older age, starting later and lasting longer than it used to.

Why It Works

It’s a simple but powerful framework – a new kind of life roadmap – where each quarter has its own rhythm, its own unique blend of challenges, opportunities, and purpose.

Saying someone is in Q2 or Q3 is simple, neutral, and gently acknowledges life’s natural evolution without being judgmental or prescriptive. (It also carries a familiar ring for anyone who’s ever worked in a business or financial setting, where “quarters” are a common frame of reference, making it a surprisingly effective metaphor for the different seasons of life.)

What I love most is its neutrality. Labels like “Quarter Three” come without the baggage that so often accompanies ‘retirement’. No assumptions, no stereotypes. Just a clear, flexible framework for thinking about life as it continues to unfold.

There’s no set script. Just an open invitation to explore what this stage of life could really be about.

Because when you understand the arc of each quarter, you start to see and understand your own journey more clearly – where you’ve been, where you are now, and where you’re headed next.

And that’s what makes this model so compelling: each quarter is a fresh chapter, full of potential and possibility… a natural moment to pause, reflect on what’s mattered most so far, and consciously shape what comes next.

Welcome to Q3 - the Start of a Dynamic New Chapter

Most people assume that our increasing longevity means tacking on extra years at the end of life – more time in Q4. But because we’re healthier, more energetic, and more engaged in our 60s and 70s than any generation before us, ‘Quarter Three’ has expanded to accommodate this development.

Which makes perfect sense.

Because maybe you’re not planning to slow down.

You’re not planning to fade away.

And you’re definitely not done!

You’re just… ready for a more intentional chapter – one that’s shaped by you, not by society’s expectations.

For me, Quarter Three feels full of possibility – far more expansive than the word retirement ever did. Because in the end, this isn’t just about changing the vocabulary – ultimately, it’s about something deeper:

- How do you want to spend your time?

- What do you want more of in your life?

- What are you ready to release?

- What feels like it’s just getting started? And what’s run its course?

For some, this time is about starting afresh, launching something new, diving into a cause, exploring the world, or making a bold change. For others, it’s a chance to slow down, reset priorities, and create more room for what brings joy.

There is no one-size-fits-all path – just an open invitation to live these extra years in a way that feels deeply true to you.

If 'Retirement' Doesn’t Fit, That’s a Clue

After circling this question for far too long, here’s where I am right now:

If “retirement” doesn’t sit right, that’s not a problem – it’s a prompt.

It’s signal to pause, reflect, and ask: What do I really want this next chapter to look like?

- It’s your invitation to rewrite the rules.

- To define this stage on your own terms.

- To create a life filled with purpose, joy, and meaning.

Seen through this lens, Quarter Three is where intention meets opportunity and where this chapter really comes to life.

Ready to rethink what this next phase could look like — on your terms?

You might enjoy my Retirement Springboard. It’s a simple, thoughtful way to press pause and reflect on what you really want next. You’ll answer a few powerful questions, from which I’ll create a personal visual snapshot – a valuable starting point for our 90-minute coaching session together.

No jargon. No “shoulds.” Just clarity, choice, and a fresh perspective. Find out more here.

Is Retirement the Wrong Word for What’s Next? Read More »