Your Three-Word Retirement Strategy

Your Three-Word Retirement Strategy

A few years back, I came across a poster that said, “It’s simple until you make it complicated.” … and these words have stuck with me ever since!

As someone who can overcomplicate things in the blink of an eye, it really struck a chord because I know from bitter experience that complexity inevitably leads to confusion, procrastination, and frustration – NOT a good place to be at the best of times and definitely not a good place from which to make important decisions!

It all comes down to choosing just three words. That’s right, only three!

The story behind 'three words'

I first heard about the “3 Words” concept many years ago from author Chris Brogan who highlighted their benefits as an alternative to New Year’s Resolutions. Unlike resolutions that tend to fizzle out by February, he selected three words to act as a gentle guide and focus for the year ahead.

People in their thousands adopted the idea because it’s quick, effective and incredibly simple.

When you think about it, moving into retirement can feel a lot like stepping into a new year. Both offer us a blank slate, a sense of renewal and a chance to reshape the future. Both are exciting and full of promise… and both can also feel overwhelming and uncertain.

That’s where those three words come in handy.

Why three words?

Instead of feeling lost or overwhelmed by endless choices, these three words bring you clarity and focus, helping you zero in on what you really want in your next chapter.

They serve as a compass, guiding you toward what truly matters and steering you back on track when life starts to feel too complicated.

For example, my current three words—flexibility, choice, and purpose—have guided me through some major decisions this year. After my hip operation, I knew I needed to take time off, focus on recovery, work on my fitness, and take a holiday. But I struggled with the decision to step away from my coaching work.

However, running the decision through my three-word filter brought everything into focus.

After all, what’s the point of having ‘flexibility’ and ‘choice’ if I don’t use them? And when it comes to ‘purpose,’ staying fit is key to fulfilling it.

So, I took 3 months off and returned feeling refreshed and re-energized!

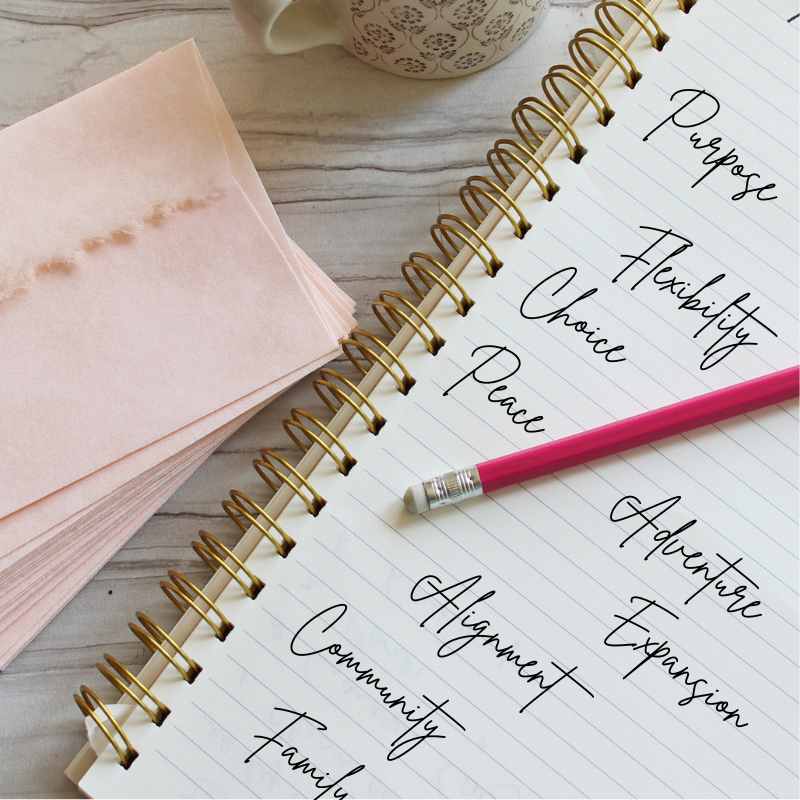

It’s always fascinating to see the three words people choose. Here are a few examples from my clients::

- Family. Connections. Health.

- Learning. Exploration. Fun.

- Peace. Simplicity. Realignment.

- Mind. Body. Spirit.

- Creativity. Curiosity. Courage.

- Ambition. Flourish. Focus.

- Purpose. Growth. Evolution.

Isn’t it interesting how three words can paint such a clear picture of what’s most important to each person?

Ready to find your 3 words?

If you’re thinking about your retirement and how you want it to look and feel, consider trying the three word strategy.

Here’s how you can start:

Do a Brain Dump

Ask yourself:

How do I want to feel in this new chapter?

What do I want to bring more of into my life?

What do I want to let go of?

What values or qualities will help shape this next stage?

Take some time to jot down any words that come to mind – just let the ideas flow uncensored.

Refine the List

After you’ve written down a bunch of words, take a look at them and see if any patterns emerge. Slowly narrow them down until you’ve got three words that truly resonate with you. These words will have a significant role to play in creating your retirement so it’s worth taking your time.

Reflect and Expand on Each Word

Once you’ve got your three, take a moment to think about why you chose each one.

What do they represent for you?

How will they help guide your decisions and actions in this new phase of life?

Take my word, ‘flexibility’ for example. This is the expanded version which reminds me WHY I chose this word.

Flexibility is an essential element in my retirement, allowing me to respond to new opportunities and challenges as they arise. It gives me the freedom to adjust my schedule and priorities, ensuring that I can focus on what truly matters—whether that’s my work, well-being, new experiences, or spending time with those I care about. It helps me stay balanced and aligned with my values as I navigate this next chapter.

As you can see, one word represents A LOT.

Simple and easy are NOT the same thing

Leonardo da Vinci famously said, “Simplicity is the ultimate sophistication,” and I couldn’t agree more. However, embracing simplicity is often more challenging than it might seem! And this strategy is about much more than identifying three words; it’s about digging deep to find what truly matters to you and what you want from your retirement.

And of course, identifying your three words is just the beginning. You need to keep them top of mind and regularly use them as a filter for your decisions and actions.

So to those of you stepping into a new chapter, I invite you to consider what your 3 Words words might be. May they guide you through the complexities of retirement toward a future filled with purpose and joy.

Your Three-Word Retirement Strategy Read More »